Treehouse hosted our first Twitter Spaces with the Ava Labs team as our first guests. The panel speakers were Matthew and Nadim from Ava Labs, and Abigail and Danny from Treehouse. YX from Treehouse moderated the discussion. We covered topics such as the current market situation and our plans for the future. Find the complete discussion on Twitter here.

Read on to find out how the panel discussion went!

Part 1: Introduction

YX: Welcome to Treehouse’s first Twitter space! Thank you for tuning in. We’re honored to have the Ava Labs team with us today for this panel discussion to talk about various topics ranging from how the macro landscape is affecting crypto at the moment to the future plans of both Avalanche and Treehouse.

Let me first introduce myself. I’m YX. I’ve been a Growth Marketer with Treehouse for almost a year now, and I am the moderator for today’s discussion. With me today are Nadim and Matthew from Ava Labs. Ava Labs is the team behind the Avalanche blockchain, which was founded by Cornell Professor Emin Gun Sirer and his group of students.

Nadim has been at Ava Labs for over a year, working within the Business Development team. Ava Labs is his first professional experience where he started off as an intern. As for Matthew, he has been at Ava Labs for about six months. He worked in traditional finance (TradFi) for a year and a half before joining. He’s currently CFA level 3 and has some base-level programming experience.

On the Treehouse side, we’ve Abigail and Danny who are both from the Strategy team. Abigail has been with Treehouse for about six months now and previously worked in FinTech startups within London. Danny has also been with Treehouse for six months and he used to be a credit trader at several banks. Thank you 4 for joining us on this panel discussion.

Before we kick it off, let me prime the audience and set the stage a little. A lot has happened in the past six months for the crypto world, from breaches, hacks, and exploits, the fall of LUNA, 3AC, and Celsius, regulation chat, and more positively, the upcoming merge – there is a lot to be discussed. This discussion will be broken down into the following large topics:

- Firstly, the industry, as a whole.

- Secondly, NFTs, mainly on the plans Avalanche and Treehouse have.

- And lastly, not forgetting something fitting for the current landscape, risk management and education.

For those listening, we’ll have a small Q&A session at the end, so do participate. Let’s kick it off!

Part 2: Panel Discussion

YX: Now, I’ll let both sides introduce your projects a little. Perhaps, you could share what your projects mainly do and the mission/vision of your projects.

Matthew: The mission of Avalanche and Ava Labs is to digitize all the world’s assets, abstract the blockchain from the user, and make the most seamless experience possible. Avalanche aims to provide a highly scalable interoperable network of blockchains that can truly expand to the level of throughput and flexibility required to cater to global use cases and assets within the world.

Abigail: Treehouse is a DeFi data and analytics startup. We started about a year ago, prompted by a struggle of our founders: to find a solution to track their own DeFi investments. They began to build a solution and quickly discovered that other people wanted this solution too. Since then, we’ve been trying to build institutional-grade analytics for DeFi users that go beyond just telling you where your assets are. Harvest gives you really actionable insights into things like your IL (impermanent loss) and P&L (profit and loss). Currently, we have a portfolio dashboard that supports over 100 protocols across a few chains. Recently, we added Avalanche to our coverage as well.

YX: Thank you both. Moving on to chat a bit about the current landscape. As mentioned, it’s mostly been dotted with bearish news, with a few glimmers of positivity. In your view, how is the industry doing right now? Are we still in the bear market? Do growth opportunities exist at the moment? What are your thoughts?

Nadim: From a builder’s perspective, it doesn’t necessarily make sense to look at growth from the market and price appreciation. I think we’re in a pretty nice spot where we are seeing a lot of activity. I think a bear market is a pretty good time for anyone to be building as long as they don’t have the pressure to be launching products or raising money.

We have seen a lot of activity, and I think builders on Avalanche are now taking the time to explore different collaborations. Since they don’t really have this pressure that the bull market can create, they can think of different ways where they can experiment and create new things. So, I think that’s overall something good for the market that’s going to help us prepare for a better overall environment once this has ended. I think we are poised for good growth, and the industry itself is still growing. It’s just the prices that aren’t necessarily following. If you have a look at everything that’s happening, specifically on Avalanche and the industry in general, you can find growth at pretty much every level, just that it is not necessarily something reflected in the price.

YX: What does Treehouse think?

Danny: I really agree with what Nadim just said. I would agree that it’s a bear market in terms of valuation and market perspective, but for confidence, which is reflected in the builders’ activity, we’re definitely not in what we would call a typical bear market. I think the building community is still quite vibrant. Developers are still having innovative ideas that they want to deploy. Obviously, the transaction volume and valuation have dropped, but the VCs (venture capitalists) are not stopping or pulling out completely. They are still finding some areas of interest that they are going into.

I think there are a couple of growth areas that I am looking at personally. One thing would be interoperability which we, at Treehouse, are also trying to build, such as cross-chain analytics solutions. There are a couple of solutions that are trying to build that as well. Overall, risk management tools are what the market is looking for right now after all of these implosions from Terra LUNA and the CeFi credit risks. I think people are starting to realize that there are actually implied risks behind all the DeFi yields that we’ve been enjoying so far. People and institutions, especially, are looking to invest as well as adopt new risk management solutions that help them understand what risks they’re taking to earn that kind of return. I do think that valuation-wise, it is a bear market, but we are definitely in a healthy building environment where people realize what is sustainable in the long run.

YX: Indeed, many share the sentiment that now is a great time for BUIDLing. Regardless of whether it’s working on interoperability or risk management solutions, the fact is that the industry remains heavily fragmented, with platforms following wildly different approaches and adopting diverging protocols. This makes interoperability and risk management both areas in which DeFi could grow. Speaking of growth opportunities, Coinbase’s recent partnership with BlackRock to offer institutional clients access to cryptocurrency was big news. What do you think? Does this signal durability of institutional interest within the cryptocurrency segment? What are your thoughts?

Matthew: From an institutional side of things, we haven’t seen a dip in interest at all. We’re actually building what’s called an institutional KYC (Know Your Customer) Permissioned Subnet. This means that the KYC process would be done at the validator level for institutions that must comply with KYC and KYB (Know Your Business) standards and AML (Anti-money Laundering) responsibilities. A lot of times, they can’t really participate in permissionless DeFi because they don’t know the counterparties across the other side of the pool.

Because this will be entirely permissioned at the validator level on the subnet, all participants will be known, and so, it will unlock a greater audience for DeFi. That’s what makes subnets so great – that they can create a sovereign permission environment in which institutions can come and create their own chain and design the parameters however they want. We’ve definitely seen an uptick in institutional interest, specifically in crypto, and even on-chain, which might surprise some people. The BlackRock announcement should help unlock some institutional capital, but that’ll probably mostly flow into the centralized exchanges.

YX: Thanks so much. What does Treehouse think?

Abigail: I think that the Coinbase-BlackRock partnership is pretty exciting. I think the institutional interest we are seeing isn’t just held down in finance, but it is in other areas as well. Recently, Disney launched its innovation program with Polygon being one of its key participants and it really shows that institutions and traditional companies are seeing cases beyond just financial speculation of tokens and assets like Bitcoin. Even more than that, I think what’s most interesting about this is that these deals and partnerships are continuing to come out whilst in this environment of struggling market prices. This is a real testament to the momentum that the industry now has, and that even new players can see. Even in low market prices, with the fall out of Terra, and other things that have happened in the market recently, this does not spell the end of the industry. Institutions are still really excited, and they are still being deployed in the space.

YX: Yes, we can only hope that this momentum continues. Thank you for both your unique perspectives. The next question would be: Coming from both of these unique perspectives, where Avalanche gives us the perspective of a network, while Treehouse brings the point of view of a multi-chain platform.

For Avalanche, how does Avalanche attract developers BUIDLing in the space? What are these developers looking for when they come to Avalanche? Have any developers come from the Terra ecosystem?

For Treehouse, what are your plans to help BUIDLing in the space? What support are you looking for from protocols and networks?

Nadim: I think most developers want a combination of good technology and good community activity on-chain. Of course, different teams are going to focus on different aspects of this. To a large extent, I think our technology and community speak for themselves. This has made attracting developers to Avalanche not the hardest task because once we are able to educate them about the technology we can offer and show them the community we have, that is a lot of the work done.

To an extent, having a set formula for supporting builders and attracting them isn’t necessarily the best way to go. We try to be as flexible and accommodating as possible with the support we provide to any teams looking to build on Avalanche. This involves getting familiar with what they are trying to build and achieve and trying to understand the different pain points that they have while suggesting different ways in which we can assist them. I think they can really benefit from the collaborative community that already exists. We spend a good amount of time getting them anchored in this community, and we try to make different connections to encourage partnerships within our ecosystem. We think this approach is much more successful than simply having teams rely on unilateral support from a single entity such as Ava Labs. As far as the support Ava Labs can provide, that’s typically just us trying to leverage different resources at our disposal. This can come in the form of marketing support—introducing these teams to different partners and providers in our network that they can leverage for whatever they are building. And, of course, we can also offer support through our various incentive programs that we have going on, such as Rush, Multiverse, our investment fund, as well as grants that we do in some circumstances.

We have seen some interest from different developers from the Terra ecosystem. There are some ongoing conversations and there are some projects that have already migrated over. I think that applies to pretty much every other ecosystem. That’s an ongoing thing, but we have seen some developers move to Avalanche.

YX: Perfect.

Abigail: Jumping in on the Treehouse side, I think partnering with people in the community is something we really pride ourselves on, and we do it in three areas. Recently our Research team has been working with partners and protocols in the industry on Insights pieces. A recent example is that we did a long-form piece on DOVs in which Friktion Labs, Ribbon Finance, and a couple of others helped us in writing the piece. It is really great to bring in area experts and people with different opinions. It pushes our research forward and brings more valuable insights to our readers. We also look to partner with protocols and their communities wherever possible when we’re trying to expand our coverage of new protocols for our dashboard. It’s really great to have their input on what metrics they want to see and they can help us understand the nuances of the rewards or unlock mechanisms or the governance proposals that are going on in their protocol so that we can better support the metrics they want to see and make sure that what we’re showing on our dashboard is really relevant for them. Finally, we partner with networks, getting a helping hand from chains like Avalanche, that can help us understand the chain infrastructure and the nuances of a new chain. This really helps us to expedite our coverage as well as in having discussions with them about the trends going on in their ecosystem, just as you’re alluding to how Terra developers are moving. Should we be engaging them to get them to be covered on our platform? Being able to reach out to the community through events like this also helps with that.

YX: I’m glad we’re all enjoying being on this panel discussion. Of course, I’m speaking for myself here as a marketer—partnerships are crucial in helping projects and the entire ecosystem level up. Compatriots are key, but competition still exists.

From both your points of view, how can projects balance seeing one another as competitors versus compatriots working towards a common goal of advancing the industry forward? Personally, I think that DeFi is still an incredibly nascent space. We saw from the Terra LUNA crash that some of the projects people had the most faith in, myself included, can still come crashing down. Many protocols are still figuring out the best technologies while weeding out fate-changing bugs. For the most part, I would say that we’re compatriots working toward the same goal of trying to advance the entire DeFi industry. This can be done through joint research, panel discussions like the one we’re having now, and even work done together on smart contracts and APIs—all in the spirit of decentralization. As for direct competitors, I do think that, at the moment, there is still so much more development space for each of us to find our unique selling point. Now, the focus is really to keep building and advancing the space as a whole. What do you think?

Abigail: Yeah. I think I’d agree with a lot of what you’ve said, YX. I guess we’re still pretty early in the space. We’ve got a lot to develop until we take the sort of technology and products we’re working on to be properly mainstream. In a sense, most people in the industry are pretty aligned on that, and that’s why we like to partner with projects and spaces. As I mentioned, it really is the best and quickest way we can push the whole industry forward and really continue putting out the best products that we can.Matthew: Yeah. From a chain perspective, I think right now everyone is competing for a limited number of resources, and the resources being users. Through this kind of lull in the market, we’ve obviously seen a downtick in transactions and users in general. I think it’s made chains get more competitive because there is a limited number of people using them. I think it’s natural to have competition when there is a limited number of resources, and there are multiple people (chains) competing for those resources—it just naturally spells competition. But to be completely honest, from an Ava Labs, or my own, perspective, I think most of us would agree that we would rather be collaborative with other chains, and we’ve actually seen this in the past. If there is a chain that wants to work with us, be kind to us, and really grow together, we’re completely open to partnerships and working with other chains.

YX: We heard Avalanche and Treehouse intend to gear up for NFTs. What are your plans in that aspect? Where do you see the NFT market going as we build toward the next bull run? Do you see NFTs gaining importance with increased functionality beyond just “hype” and “aesthetics”?

Nadim: Yeah, I’d say we’ve definitely been gearing up NFTs to a large extent since the inception of the chain. We initially focused on getting the initial infrastructure going, and getting the core DeFi protocols that you would need as the base infrastructure. We look at NFTs as something that could be done by the community, mostly organically. But recently, we’ve had a very large NFT push where we focused on getting all of the necessary infrastructure pieces to really help the community bring this art out. Now that we have a dedicated NFT team that’s shepherding the community and getting all the necessary infrastructure, we’re starting to see more and more activity. It’s really an exciting time to be in this NFT ecosystem because it’s still nascent but in my opinion, very promising, and it’s going to be quite exciting to see how it evolves. We’ve recently seen a lot of collections launching, and we’re starting to see competition between different marketplaces. If you’re an art collector, now is a pretty nice time to get familiar with our NFT ecosystem.

In terms of how NFTs are evolving, I think we’re really seeing a shift towards having NFTs having more utility—not necessarily utility in the sense where you buy a profile picture (PFP) and then you get access to specific perks. It’s also actual on-chain utility such as seeing the start of ticketing NFTs, or stuff like identity NFTs, and transferable NFTs that can be used to port all kinds of different credentials and chains. You can also see the different financial NFTs that are starting to appear in DeFi protocols as a good way to track positions. So, I think NFTs have captured some potential just through art at the moment, but there’s so much that’s still coming, and we’re really geared for the next bull run with this new utility that’s going to come into the NFT space.

Danny: I think that makes a lot of sense, what Nadim just said. When I think of NFTs, I break it down into two parts. One of them being collectibles, art, and even assets, as some people suggested. Another will be the fundamental and technical implications of NFT technologies. The collectible NFT market has definitely crashed alongside everything else because Jerome Powell has decided to say that “the party’s over”. But obviously, it’s a very nascent market, and we cannot say it’s “dead” yet because the community behind it is very strong. The kind of people who are bonded together by owning the same kind of art collectible NFT is incredibly strong. These are bonds that cannot be broken down just by a period of low valuation.

In terms of the fundamental and technical part of NFT technology, Nadim just talked about a lot of their use cases. In TradFi, we’re seeing banks use NFTs to track unique and complex positions, especially on the fixed income side, because a lot of the instruments are quite bespoke and the traditional on-chain ledger system that some of the banks have developed might not be quite suitable enough just yet. But when they add on the NFT layer, that can actually serve those functionalities. We also see the growth of Uniswap V3, which is using NFTs as a position ledger. We also have other on-chain options, derivatives, and other kinds of protocols on chains like Solana that are using NFTs as their bespoke options position tracker. So, I think the technical side is really being explored by the developers right now and new use cases are continuously being discovered. I do think that this will eventually feedback to NFTs as art collectibles because there are some unresolved issues as an IP tracker with NFT technology. The development of use cases will feedback and then probably help the collectible market in the future as well.

YX: Those are really well thought-out answers. Definitely agree. There’s still so much potential with NFTs to be explored. Hopefully, Avalanche projects and Treehouse will have many opportunities to work together in the future on this. Just plugging Treehouse a bit here, Harvest is now tracking Uniswap V3, so do check it out!

Moving on, I’ve noticed that there is sometimes a gap between DeFi and NFT-only users. How do you think we, as Web3 companies, can help bridge this gap and expand user adoption? How do you think we can adapt the community-centredness of NFT communities to DeFi communities? Let us know!

Matthew: I think it really just starts with education and user interface. For a lot of people, DeFi can be daunting, especially when it comes to more complex financial instruments like options or perpetual positions. And so, I think having good educational content and a good user interface really allows for a very smooth process for the user, an intuitive process in which they know exactly what they’re doing. A trend we’re seeing in DeFi is sustainable yield. You guys might have seen “real yield”. It basically just means that the yield will be there regardless of market conditions, whether it’s a bull or bear market. It’s delta neutral, which means price can go either direction, and you’re still getting yield from the protocol you’re working with or the yield farm or yield protocol you’re using. It really starts with education, before moving from there to the user interface, and then having proper security. At the end of the day, no one wants to lose money, and security should be a top priority for basically every protocol.

It’s an interesting phenomenon to think about. NFTs, like you said, have a real sense of community. But at this point in time, DeFi isn’t really the exact same. If you think about it, do you know anyone that cheers for the bank they’re using or is super excited like, “Hey JP Morgan Chase, they’re the best bank!”? It might actually be hard in some ways to get that sense of community in DeFi just because it’s not as “sexy” as something like NFTs or gaming, or something that has more visual effects. It’s kind of funny to think about because personally, I don’t know anyone that gets hyped up for the centralized bank that they’re using. So, DeFi might be similar where they’re getting this great yield from a very safe underlying protocol with a great team. They could be very happy about it and really entrenched within the community, but they might not be as vocal as a cheerleader or something like an NFT community.

Danny: Coming out of banks, I definitely didn’t see anyone being a cheerleader there. Comparing DeFi and NFT communities, NFT communities are bonded by similar interests and appreciation for a certain type of art. Just imagine, you’re in a fan club of Star Wars and you go to the club meeting: everyone is talking about their new collectible lightsabers and you’re immediately bonded with each other. However, let’s say you’re Berkshire Hathaway’s shareholder, and you attend the shareholders’ meeting. You’re not going to say “Hey, cheers!” to the other shareholder, who is probably 50 years old and rich, sitting next to you. You’re not going to be bonded immediately like that.

In DeFi, the first priority is to make money, so the sustainable yields coming from new channels are definitely a game changer. An example would be selling options and sustainable borrowing and lending instead of heavily incentivized and unsustainable token yields. Over time, this will definitely attract the real appreciators who understand what alpha in DeFi gives you financially. Also, I do think DeFi actually had its moment of having a closely knitted community, taking the LUNA community as an example. For those who were LUNAtics: when they meet each other, they’re probably still going to cheer for each other. There was a time when everyone was making big money from one single project—that’s when DeFi communities were similar to NFT communities. But right now, with financial markets in this state, we’re definitely missing a bit of that. I don’t think this would be the top priority from the perspectives of the developers or chains. In DeFi, you just need to attract the right people, but those who have the right mind to make money probably wouldn’t be as hyped as Star Wars fan club guys.

Matthew: I completely agree. In a lot of ways, people have forgotten that DeFi had been the enabler for basically all of crypto. DeFi Summer really revolutionized the space, so DeFi, in a lot of ways, had been the backbone or infrastructure for a lot of protocols to build on. Some examples would be gaming protocols that need an AMM (automated market maker) to be able to swap in-game tokens or even SudoSwap, which has the DeFi element seen in their NFT swap platform. I think you need DeFi as the infrastructure or base layer for a lot of applications to build on top of, and it really enables revolutionary products to be built on blockchains.

YX: Definitely agree there. DeFi really created a lot of accessibility and functionality for people. As a marketer, I’d also like to add that many elements of the NFT communities can be adopted by DeFi projects, especially in terms of onboarding users into DeFi. RabbitHole is one project that has made a very good attempt here.

Onto the next big topic, one that is very fitting for the times we’re in now – risk management and education. The contagion effect leading to the cryptocurrency crash this year has resulted in more projects focusing on risk management and education. What are your thoughts on this, and what steps are you taking in this area? How can we help users navigate DeFi better?

Abigail: In many ways, risk management has always been a core of what Treehouse is doing and one of our main drivers. Many of our team, with a TradFi background, are very much used to properly understanding our investment risk. It’s something we’ve always been aware of, and something we thought was necessary to develop in the space. It is also something that is necessary for institutions to be able to come in and feel comfortable. It’s quite nice for everyone to come down a bit from the bull market mania and to be on the same page as us on this for once.

In terms of what we’re doing, our dashboard has a number of tools that help users understand risk. We’re able to show your exposure to tokens and chains, your position performance breakdown, your exposure to DeFi-specific risks like impermanent loss, as well as protocol metrics that will help you understand your smart contract risks. If you’ve invested in a certain protocol, what are the exploits that have gone on in that protocol? What are the audits that are being conducted? We also try to support this with our research. Recently, we published a Treehouse Academy series trying to explain to people different terms and risks like slippage and impermanent loss, as well as longer-form Insights pieces, including Harvesting Risk Premia, which describes to readers the risks inherent in DeFi. I really recommend, if you haven’t already, to take a look at this piece. It’s a really good introduction to risk management and can really help users in this current climate.

YX: Thanks for sharing. Good to know both sides share similar sentiments on risk analytics. I do as well. Speaking of risk, some stablecoins that we’re familiar with faced trouble this year, but stablecoins still remain integral to crypto. How do you view the industry’s dependency on stablecoins?

Matthew: Stablecoins was honestly one of the top three innovations in crypto, maybe even number one. Being able to permissionlessly move money across borders and give access to the most stable currencies in the world is a big deal because a lot of currencies hyperinflate and people lose their wealth. Now, people have another non-volatile asset to put their money into that might not even be a cryptocurrency, since coins like Bitcoin and Ethereum are very high-volatility assets. They have a beta that is clearly riskier than market neutral conditions, and people need a safe haven to go to when there is market volatility or when their own currency has volatility because of hyperinflation. Stablecoins really enable something almost like a life raft for a lot of people in various nations that need access to that life raft.

Danny: I agree with what Matt has said. If I go down to my neighborhood coffee shop one day and there’s a stable price tag for the cup that I need, rather than it being 1 BTC today, and the next day, 0.5 BTC, and the day after, 2 BTC. With that kind of volatility, the regular cryptocurrency that’s counted as “decentralized money” just doesn’t work. We need something that is stable in value to facilitate as a medium of transaction. Currently, even with all the arguments around decentralization risks and regulation risks, I think stablecoins are actually moving into a healthier state as we phase out all the bad actors within the system.

YX: Fascinating points. I believe stablecoins are super integral to our ecosystem, and they won’t be going away any time soon. Lastly, I have to ask this: What’s Avalanche and Treehouse most excited about for the next six months?

Matthew: We actually have a lot going on, both public and private, happening in the next six months. There are a ton of very exciting protocol upgrades that will be launching that unfortunately I can’t talk about, but pay attention to the next six months! Hopefully, you guys are wow-ed when you figure out what we’re building.

In terms of on-chain protocols that I can talk about, we’re having a few permissioned subnets that are coming out—one being the institutional DeFi subnet which will have KYC and KYB at validator level so both users and builders will have to be KYC-ed, which will allow more institutional adoption that needs to be fully compliant. Another super exciting project is called Intain. Intain does structured financial products on the blockchain. They were originally built on Hyperledger, but are actually making their own permissioned sovereign subnet. Financial structured products just mean asset-backed securities, mortgage-backed securities, etc. They are actually building their own subnets and are currently working with a few small to mid-sized banks and have over 4.5 billion assets that they have administered. They’ve allowed organizations to use their Hyperledger fabric, and that’s moving over to their subnet. In terms of NFT and gaming, our NFT ecosystem, in general, has been blossoming for the past two or three months. We’ve really seen a niche group and some absolute diehard people on our blockchain. They have basically Twitter spaces every single night, talking about NFTs and music. This is really a growing culture within our ecosystem. Some of the leading marketplaces we’re seeing are Joepegs, Campfire, NFTrade, Kalao, to name a few, and it’s only going to continue to grow. In terms of gaming, because subnets allow for a sovereign environment, a lot of these games will use their in-game currency as the gas token. Our gaming pipeline, I can confidently say, is top three, or it might just be number one. Starting in October or November this year, you’ll start to see a flurry of games. Eventually, an avalanche of games will come through. There’ll be a ton of very fun games both from an indie-gaming environment as well as AAA. We’ll have games for any user and whatever games they’d like to play, whether it’s as a shooter, MMORPG, strategy-based games, indie, turn-based games, or pokemon-style games—there’ll be a lot in the next six months.

YX: What does Treehouse’s next six months look like?

Abigail: I think there’s a lot to be excited about in the next six months, both from the market and product perspective. In the market, we’ve got the TOKEN2049 event coming up in our home city, Singapore. Listeners should check that out, we’re doing a lot of fun things, and there might be some interesting launches going on, so keep your eyes peeled for that. In terms of product plans, we’re going to be exploring how to support DeFi users across their investment life cycle, so we’re not just tracking their existing investments but trying to help them discover new investment opportunities and protocols that have just emerged. As Avalanche was talking about all the new protocols coming out, we’ll be helping people find those to conduct due diligence and execute the strategies they need to use, having done this research. We’ll also be expanding our coverage—we’re looking to expand into L2s and new asset types such as perpetuals, options, as well as NFTs.

YX: Keep your eyes peeled, indeed. Guys, this has been a great discussion. Both your pipelines sound great! Thanks for your contributions. Now, we’ll open the space up to the floor for questions. Please raise your hands if you wish to ask questions. If you wish to direct your question to a particular panelist, do indicate so. We will pick a few for our panelists to answer.

Part 3: Q&A

Matthew: How’s everyone’s day going? Anyone doing anything fun so far? Anyone have any big plans for this weekend?

YX: Planning TOKEN2049. What about yourself?

Matthew: Honestly, not too much this weekend, I went through the conference grinds the past few months, but I think I’ll probably end up going to one more. So, maybe just relaxing, it’s actually a holiday in the U.S. here on Monday. Maybe going for a hike through the long weekend.

Nadim: I just discovered we’ve this holiday yesterday, so I might want to make plans just because I got a long weekend, but I don’t know what exactly I want to do. It’s going to depend on the weather, which is starting to get worse.

Danny: Are you guys all based in NYC?

Nadim: I’m in London myself and not in New York.

Matthew: I’m actually on the move to Denver, Colorado. But I’d say 60 to 70 percent of Ava Labs employees are based in New York City.

Danny: That’s great. If there are no questions from the floor, I have a question I’m just curious about for our AVAX counterparts here. We’re seeing a lot of fundraising rounds for the new alternative L1s, like Aptos and Sui. They’re really the spotlight of the VCs, and a lot of developers have gone on the testnet of Aptos. I just want to see your perspective, as an OG (original) chain and EVM (Ethereum Virtual Machine) chain as well, where do you see the ecosystem go in terms of chains? Do you think OG chains will go into more specialized use cases as you mentioned: sovereign chains and permissioned chains? Or are the old chains still trying to do everything and compete on a full front scale with upcoming challengers?

Matthew: The great thing about Avalanche as a chain is how customizable it is. Technically, we actually could have a Move subnet that uses our consensus (Avalanche Consensus), and it can essentially be a whole ecosystem if builders want to build a whole ecosystem on this Move-related subnet. From our perspective, subnets are really our way to scale, but they are also our way to innovate. MoveVM (Move Virtual Machine) uses an iteration of Rust which is a programming language. We could actually have a Move subnet with its own ecosystem, and that’s what the beauty of Avalanche is. I think in the future, we’ll have these custom VMs, app-specific chains, or custom VM subnets where they’ll be specifically tailored to the process they’re doing. There’s a very interesting thread on Twitter about central limit order books and how they basically would need their own VM that’s specifically tailored to being a central limit order book. That’s what we’ll continue to see. This may not be a year from now, but maybe 2-3 years from now. It might not even be EVM, MoveVM, or any other VM, but just a custom VM that’s tailored to that application and what they are doing.

Danny: That makes a lot of sense. I think the interoperability and composability that are allowed on the Avalanche chain and infrastructure are very promising in terms of sustainable growth and the attraction of new projects. Thanks a lot for that!

YX: I guess we’ll not know what’s going to happen in the next couple of months or years. As for central limit order books, that’s a really interesting application.

Listen to the full panel discussion on Twitter Spaces here!

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

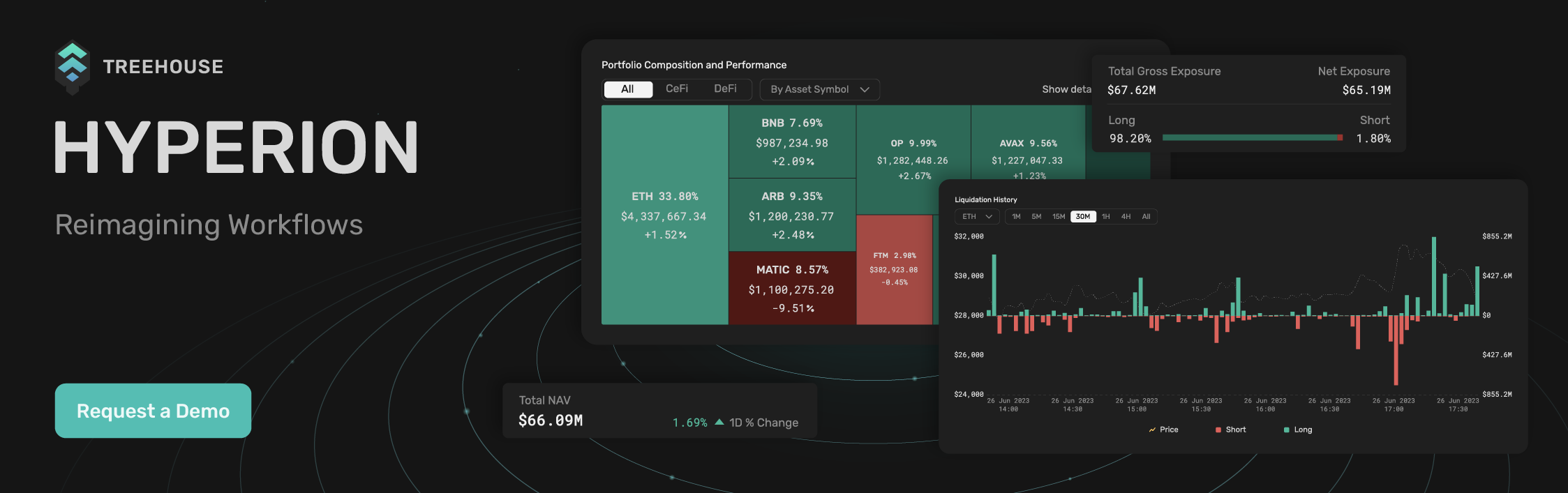

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.