Treehouse hosted “In the House #3: DEXs After CeFi”, another addition to our Twitter Spaces series. We had a fruitful discussion with Cliffton from dYdX, @coinflipcanada from GMX, and the Chief Investment Officer (CIO) of Ouroboros Capital, “O”, on the panel, moderated by Danny from Treehouse. We compared CEXs and DEXs and discussed sustainable engagement in DeFi communities as well as the issue of liquidity fragmentation across chains. Listen to the complete discussion on Twitter here.

DEXs: Decentralized Exchanges; CeFi: Centralized Finance

Read on to find out how the conversation went!

Part 1: Introduction

YX: Hey everyone, I’m YX, and I’m just here to give the introduction to all the panelists before we begin. Welcome back to Treehouse’s Twitter Spaces, which, if you notice, we’ve now renamed to ‘In The House.’ If you don’t get that, it’s a play on our name, Treehouse. Thank you for tuning in.

So today in the house, we’ve @coinflipcanada from GMX, Cliffton from dYdX Foundation, and the CIO from Ouroboros Capital, who we’ll refer to as “O” here to discuss with us the topic of “DEXs after CeFi”. We’ll explore the state of DEXs versus CEXs post-FTX’s collapse, why and how DEXs and DeFi, in general, should foster, engage, and incentivize their communities, as well as the impact of liquidity fragmentation across chains, Layer-1s, and Layer-2s on DEXs. Danny, Treehouse’s Head of Research, will be moderating the conversation.

Before we get started, let me first briefly introduce all the panelists and the projects they represent. @coinflipcanada is part of the core team at GMX, a decentralized spot and perpetual exchange that supports low swap fees and zero price impact rates. Currently, on Arbitrum and Avalanche, GMX is widely known for fostering the DeFi mindset of engagement and building amongst its community of users. Next, an OG in the perpetual space, dYdX is a professional perps trading exchange that needs no introduction. Cliffton works for the dYdX Foundation on all things governance and operations related. He’s a big proponent of DeFi and decentralization and has been with the dYdX Foundation for seven months. The dYdX Foundation was created to foster community-led growth and the self-sustainability of the dYdX protocol. With dYdX building out its own sovereign chain using Cosmos Software Development Kit (SDK), Cliffton is focusing on decentralized autonomous organization (DAO) structuring to progressively decentralize the protocol from end-to-end, as well as understanding how governance under Cosmos will change from its current state under Starkware on Ethereum. Ouroboros Capital CIO, O, who runs the Twitter account @OuroborosCap8, is here with us today to represent the user and hedge fund side of things. O largely engages in liquid tokens longs / shorts but also does some venture capital and advising for several projects, including Radiant and a GMX Fork that’s about to launch. Thanks for coming on, you guys. I’ll let Danny have the floor now.

Part 2: Discussion

DEXs Industry Landscape

Danny: Sure, thanks YX, and thanks for joining everyone. We’re going to kick off with the general question of how the panelists view the DEXs industry landscape and thoughts from their own perspectives. We’ve Ouroboros here as a liquidity taker from a trading perspective, and then we’ve two prominent builders from the community—from GMX and dYdX. Let’s pose this question to them: How do you think, post-FTX, is the decentralized exchange ecosystem doing? Where do you think is the largest hurdle for the next step toward mass adoption? As a personal user, what do you think is the next thing you want to see? Why don’t we start with O?

O: Hey guys, thanks for having me. First, I think this is definitely a very topical discussion. Post-FTX, the narrative of “not your keys, not your coins” and “don’t trust centralized exchanges and don’t leave coins to the custody of centralized exchanges” has certainly been amplified, but I’m still of the view that there’s still much that’s lacking with DEXs. I just posted about this today on my Twitter, saying that it’s extremely annoying that Binance has position limits on perps. Binance just cannot fulfill or displace the void that FTX has left.

More importantly, what I’m trying to emphasize is that centralized exchanges provide capital efficiency; they allow you to go 10× or 20× leverage on a trade. I’m not saying that’s what everyone should be doing, but for a hedge fund, for guys like us that run the occasional market-neutral positions, it’s important. First and foremost, we’re not a market-neutral hedge fund. We’re discretionary long / short, so I do have short and long biases. But for us to put on huge market-neutral trades, and if you think about it, market-neutral positions tend to be smaller in terms of returns, leverage and capital efficiency are important.

Right now, I don’t think that there’s any sort of perpetual protocol that can displace centralized exchanges in terms of capital efficiency and in terms of portfolio margining. Let alone talk about decentralized apps (dApps). Even Binance, for example, its perpetual treatment on leverage is just insufficient, which, again, makes me wonder if the leverage engine on FTX was truly functioning. It was a haven for many institutional crypto hedge funds, but it makes you wonder if that was properly functioning and if that was really something that could have existed, aside from all of the shams that’s happened to us. That’s just my view at the moment. I think we’re still years behind the sort of experience that can occur on a centralized exchange that the dApps have yet to come close to.

Danny: Okay, alright, thanks, O. So from the liquidity taker perspective, we’ve heard their thoughts. How about on the builder side? Cliffton, do you want to take it first?

Cliffton: With the recent FTX collapse, we’ve seen a ton of flow come into the DEX space. As far as my own personal views go, I actually think even with all this negativity, DEXs and centralized exchanges will probably coexist in the short term because if we’re talking about the everyday non-crypto native user who wants to get into crypto, the centralized exchange experience, on the whole, is just a lot easier. Let’s talk about a couple of key steps: we start off with the standard Know Your Customer (KYC) onboarding process—everyone in Web2 is super familiar with filling up a form, filling up their emails, their addresses, etc. The KYC process on centralized exchanges is the same. If you ask the everyday non-crypto user to actually create a self-custodial MetaMask or wallet, it’s going to be tough for them to understand why and they’re probably going to be jumpy around storing their private keys as well; they’re not going to understand the logic behind that.

There are also fiat on-ramp capabilities that a lot of DEXs just can’t compare to centralized exchanges. If people want to go on the DEX right away, they will probably still have to go through a centralized exchange to deposit fiat, swap it to a stablecoin, withdraw it to their self-custodial wallet, and then create an account or register their wallet with the DEX before even starting to trade. It’s just a super tiresome process, and it’s just not the best user experience. There are also things like ease of getting yield with the click of a button on the same platform. We’ve seen this with Coinbase Earn—a lot of centralized exchanges actually offer that, where you just have to click, and then you can start earning yield on your assets. In DeFi, it’s a little bit different; you really need to know where to find yield, and more often than not, it’s not that easy to find because you just get so many options, and again, the user experience is just not the best.

Lastly, I’d say the presence of an identifiable team. Obviously, a few DEXs are good at doing this—we’ve Uniswap with Hayden, and we’ve dYdX with Antonio, but we still have a lot of widely used DEXs like Curve where the team is mostly anonymous or non-high profile. I think this trust factor is often understated, from a customer standpoint, because branding to the non-crypto masses often comes with being able to identify a product with a team or an individual per se. we’ve Binance with CZ, FTX before it collapsed with SBF, Coinbase with Brian Armstrong, and Gemini with the Winklevoss twins. But I think recent events have really proven the value of DEXs, and I can confidently say that 99% of DEXs cannot use or even access customer deposits, so shenanigans like using customer deposits to recklessly trade or do inappropriate purchases are impossible.

It’s all about transparency when it comes to DEXs; everything is on-chain. When we talk about adoption, it all boils down to user education and a big focus on UI/UX, both of which, unfortunately, are not very well done today for DeFi in general. What I’m hopeful for is that in the short term, users will want to understand the importance of self-custody, why DEXs cannot do what centralized exchanges can with customer deposits, and gradually create and migrate their assets over to their own custodial wallets. In the long term, I’m pretty sure many DEXs are looking at improving product features and the overall customer experience as well.

Danny: Makes sense. Thanks a lot, Cliffton. One thing that Cliffton just brought up is that you want some brand image and maybe a face to a name when it comes to centralized exchanges. That brings us to an interesting point on @coinflipcanada’s side, who’s from GMX, which is built completely by an anonymous team. So @coinflipcanada, how do you think the current industry landscape gives teams like you guys a unique opportunity to come in? What are your thoughts on the industry going forward?

<Technical issue>

Danny: Unfortunately, there’s a technical glitch on @coinflipcanada’s side. I actually have one question for both Cliffton and O. In response to what you just said, for O, you think there’s been a void in terms of a capital-efficient way of getting liquidity for some of the token positions that you would like to put on after FTX failed. Do you think any of the traditional finance infrastructures can step in? With that, I’m not just talking about Chicago Mercantile Exchange (CME) exchanges that might offer more products such as futures, but also some of the traditional finance market makers who deploy massive balance sheets and market make not as the quantitative guys do, but mostly as a franchise business. Do you think these guys can come in and potentially help to solve the liquidity issue after the FTX void?

O: 100%. A saying that I really like is: “The color of everyone’s money is the same”. If you think about it, at the end of the day, capital is capital. The void that has been left is clearly a function of Alameda leaving the market; they were one of the biggest liquidity providers, both on FTX and the other centralized exchanges, as well as the contagion that it caused in terms of one, the dead bodies or massively crippled market makers that were either hurt and licking their wounds right now or, you know, just the adversity to deploy capital on centralized exchanges in this current environment. I think anyone with capital, be it the Citadels and Susquehannas of the world, if they do come in and start participating in the same type of activity that Alameda did; definitely, I think we’ll see a return in terms of liquidity. I think they’re not coming in because, at the moment, post-FTX, how could they? It’s almost impossible for any big TradFi firm to trust leaving their money on any centralized exchanges at the moment.

So the answer to your question, you mentioned if there are TradFi instruments or mechanisms that would be able to help us enhance liquidity—I don’t think so. In fact, there are many already very innovative liquidity instruments on crypto that we don’t actually see in TradFi. Perpetual contracts, for example, you know, the way you sort of rebalance Open Interest (OI) skews or sell/buy skews using perpetual funding rate. That, in itself, is a crypto-native innovation. Maybe there are some solutions, but they do not come to my mind.

Danny: Definitely, that makes a lot of sense. The mindset is just different. It’s just a possibility that whoever has the deeper wallet might come in. For dYdX, quick question as well—Cliffton, you mentioned that right now, centralized exchanges serve as the gatekeeper for a lot of the user onboarding and on-ramping/off-ramping from fiat into crypto. So, what is dYdX doing? I understand there are some initiatives on your side that help new users to onboard into DEXs and ensure a smoother trading experience on DEXs.

Cliffton: There are a couple of things that we’re doing. We recently integrated with Banxa. That allows users to directly on-ramp their fiat into their Starkware dYdX account without having to go through the steps of first getting USDC from other platforms, whether it’s from other DEXs or from centralized exchanges, and then subsequently depositing it into their dYdX account. Hopefully, this will help our users to more easily navigate their way into dYdX and into a DEX if they don’t want to go through a centralized exchange, given the whole debacle behind FTX and all the other centralized intermediaries collapsing in the past year or so.

One other feature on the UI/UX side is that we’ve built out a “swap mode”. This allows users to easily trade perpetuals with leverage through a familiar swap-style UI, which Uniswap has made mainstream. One big thing that I touched upon earlier was user education. On that front, we’re gradually hoping to invest more resources, not just us, but dYdX DAO as a whole. Now, we’ve what we call the dYdX Academy. It’s very similar to what Binance and a lot of other centralized exchanges have. It’s just an educational platform which guides users on how their first baby steps on how to set up their own custodial wallets and why it’s important. What are mnemonic phrases? How is it different from a centralized exchange? What are private keys? And so on. We also teach users about the different financial derivatives. We teach them what perpetuals are, what funding rates are, and what the different jargon that’s used, like OI and leverage, are. Overall, I just think that education is just something that we find centralized exchanges like Binance and Bybit do very well. Moving forward, if we really want to onboard the masses, DeFi platforms should really invest in educational materials as well. These are all initiatives which, ultimately, aim to onboard non-crypto users, and it also helps to make the user experience of trading on the DEX a better one. Hopefully, if all of these are done well, then we don’t need centralized exchanges at all, but that’s just a long-term utopia that we’re all working towards.

Danny: Awesome, education is definitely one of the big hurdles that we need to work on collectively as a community as DeFi builders. @coinflipcanada is back on, so we’ll try again with what you were trying to say.

@coinflipcanada: Previously, we were just talking about this whole issue of “how do you deal with reputation within the crypto space?”, especially for an anonymous protocol. I was just trying to highlight that, to a great extent, anonymous protocols actually get held to a higher standard. Their code typically gets scrutinized a lot more by those who are deploying capital. To use an example, many of our contributors engage with a lot of institutional capital that is deployed for trades while utilizing the liquidity pools on GMX. The questioning is thorough, and we all work to provide that feedback. It’s just part of the ethos of the community, sort of if you think about the way that an open-source software generally works—there’s a lot more input and a lot more review.

I think that process has typically happened with most protocols that are run by anonymous organizations. That’s one interesting aspect, and how you establish a reputation at that stage really does come down to the actions that you’ve taken, the code that’s been deployed, and the consistency with how things perform. I think it’s just a matter of changing the paradigm a little bit. Obviously, in an ideal world, you don’t rely on anyone, you only have your key, and you have your assets. But obviously, as you enter DeFi, you are invariably trusting “something”; that’s typically the code that’s been deployed. So, you do need to find other ways to also let people who are less familiar with the space find out what is reputable, and that’s a challenge that, as an industry, we’ll keep working on.

<Technical issue>

Danny: Sorry about that. We’ll just continue with the other two panelists for now. One of @coinflipcanada’s points was very valid—for those of us already in DeFi, who are degen enough, know crypto twitter (CT), and know how to navigate ourselves through protocols, it’s easier to build our own trust towards something that’s anonymously built. I definitely understand that people hold “anonymous protocols” to higher standards before they’re willing to deploy capital. Still, there’s a big question of: How do we gain trust from the people who are not onboarded to DeFi yet? That brings us back to Cliffton’s earlier point of providing education.

DeFi Community Fostering and Sustainable Engagement

Danny: We’ve spent quite a bit of time on this first pillar of our discussion; that’s essentially the industry landscape. We can move to the second pillar, given that we’ve already mentioned a couple of points. Let’s discuss about DEXs, DeFi community fostering, and incentivizing sustainable engagement from users and communities in terms of liquidity provision, governance, and nurturing organic proposals that align the interests of the builders and the industry.

O, if you can talk about your perspective from the investor side when you look into different tokenomics or how the community has been behaving, what kind of green flags would you look for? Then, maybe from the builder side, Cliffton, if you can add what kind of measures dYdX is taking towards more sustainable community-building?

O: You’re talking about green flags in terms of the venues or in terms of the tokens invested?

Danny: I would say in terms of the tokens of the venues. So, let’s say if you decided to go into GMX, what was the green flag that you saw? Obviously, GMX token is the token of the GMX DEX itself. There might be other cases where these two can be a bit separated, but yeah, I think take your pick.

O: I think, first and foremost, in terms of looking at these things from an investment standpoint and also using them as a venue, there are definitely a lot of overlaps in terms of assessing these things. I mean, firstly, it’s about whether the team has stocks, what they used to do, what their credentials are, who’s backing them, etc. And then there’s the security, that’s more like what governs and what are the admin privileges of the smart contracts, who are the multisig signers, is it immutable, what sort of changes can the team make to these admin privileges, etc. GMX, for example, I do know is quite transparent in terms of these things. They have a US$500K or US$1M Immunefi bounty that helps as it deters any sort of potential ongoing plotting of an exploit happening because it would be attractive enough for a white hat hacker to work on and detect bugs or flaws. These, in general, are the things that I tend to look out for at first glance.

Danny: Awesome. Cliffton, what do you think from the builder’s side right now? What is dYdX doing? What is on the roadmap?

Cliffton: For all exchanges, liquidity is the most important thing, so how do we actually ensure that there’s sustained liquidity, and it’s actually healthy liquidity and quality liquidity. First and foremost, dYdX is actually a DEX which uses an order book model, so it’s very different from the DEXs that a lot of other people are familiar with, like Uniswap, where it’s an automated market maker (AMM) model. Because of our order book model, which is actually something that’s familiar to TradFi folks or crypto hedge funds that do a lot of high-frequency trading, there’s a trade-off in that we require more professional crypto hedge funds and market makers to provide liquidity, unlike an AMM, where providing liquidity has lower barriers to entry. So to that, our focus has always been to target yield mining towards incentivizing liquidity provision, and this has been something that has worked well with centralized exchanges as well. Things like monthly maker rebates for the different markets and preferential fee tiers have been super helpful. What we also have is a liquidity provider rewards formula which kind of scores and rewards quality and sustained liquidity, and it directs token rewards towards liquidity providers (LPs) on participation in markets, maker volume, two-sided depth, spread versus mid-market, and uptime area. So, I think a combination of all these has actually enabled dYdX DEX to sustainably get deep liquidity across most markets. That’s on the maker’s side, and on the taker’s side, we’re at the stage where we no longer rely as much as we previously did on token incentives to attract users to trade.

Please don’t get me wrong here, it’s not like we’re being complacent or resting on our laurels, but we actually did reduce our trading rewards by 25%. We even wound down our staking modules where users could previously stake their USDC or dYdX tokens to earn yield, and all of these actions were actually voted on by the community themselves. This actually gives us the sense that the demand to trade on dYdX itself is still relatively strong and that the everyday user of dYdX doesn’t actually need the additional incentives to trade on our platform. It’s more of the product experience that’s keeping them, and not token incentives. Ultimately, it’s pretty encouraging, what we’re seeing on the taker’s side. That’s it. On the building side, we’re building out the dYdX chain, what we term as dYdX V4 on Cosmos right now, and the aim is to completely decentralize the protocol from end to end. What we’re doing is encouraging a lot of discussions from our communities on how dYdX DAO can consider using tokenomics to continue to incentivize or even exponentially grow on the protocol—whether it’s fee switches, whether it’s listing of new markets, whether it’s adjusting of risk parameters—all of this will actually be open-sourced and for the community to decide on in V4. That’s what we’re doing on the community side to incentivize sustainable governance of the protocol.

Danny: Absolutely. Thanks a lot, Cliffton. I just got word that we might be able to have @coinflipcanada back again. On this pillar, what we’re discussing is community fostering to incentivize sustainable liquidity in DEXs. As for GMX, it has a very distinct model of liquidity—it’s not a central limit order book, and it’s not AMMs, it’s essentially a central clearing party of all liquidity providers versus the perpetual traders. Are there any plans to retain the community around you? I understand that the tokenomics design is already partially achieving that, but how do you guys retain users once the forks come up on other chains, and they fork out more money to try to lure people away? What’s the protocol’s plan on that front?

<Technical issue>

Danny: I’m having a bit of a problem hearing clearly, but we’ll get the answers in written format from @coinflipcanada so that we can still share with the listeners here. We apologize again. We’ve heard some opinions about this second pillar regarding community fostering. There’s another pillar which is the last one that we’re going to talk about before entertaining questions.

Liquidity Fragmentation Across Chains

Danny: The last one that I was wondering about, and this is for both Cliffton as well as O, is what do you think about the liquidity fragmentation across different chains, namely L1s and L2s? What do you think about the impact solutions, such as interoperability, have to do with evening out or moving liquidity from where it’s too cheap to where it’s most needed? Do you think those solutions are necessary right now? What do you think is missing in evening out the liquidity distribution between different ecosystems? O, maybe you can take that first.

O: I don’t think it’s a massive issue for most coins. I mean, if you think about it, for most of the stuff we trade, the liquidity is quite accessible in most DEXs, apart from the obvious shit coins or the small-cap coins. That’s where liquidity is really fragmented, where you’d need to care about liquidity, but for the most part, liquidity tends to be on Ethereum, and I have a separate thing about BNB later. But the fragmentation of liquidity so far, I don’t think it requires any sort of trade aggregator to be interoperable across chains for us to optimize for a certain degree of slippage reduction such that we overcome certain challenges when it comes to trading.

Where I think it’s really interesting is BNB because if you think about, you know, most of the coins traded on most chains are either the big majors like wrapped BTC, wrapped ETH, and usually paired with a couple of the native protocols to that chain. But BNB, if you think about it, is the only major coin that has liquidity sitting on one chain, which is Binance Smart Chain (BSC). This means regardless of which chain you feel more secure about, such as Ethereum, if you want to trade BNB in size, you have to go to BSC. That in itself creates a very interesting dynamic in the sense that if we talk about capital efficiency when it comes to trading perps, or capital efficiency when it comes to leverage trading, any sort of platform building on a low-latency chain will need to find a way to connect that BNB liquidity into the dApp.

By extension to that, and we talked about it in the first part of our discussion, the current DEX environment is extremely capital inefficient is sort of inherent to the AMM model, which means the next evolution for any sort of on-chain decentralized perp or capital-efficient way of trading via margin or leverage needs to be a central limit order book (CLOB) model, similar to dYdX. I understand that some people might push back, saying, hey look, GMX is not a CLOB model, but that’s sort of separate. I think, for very efficient liquidity, especially when it comes to much, much, much smaller coins, it needs to be a CLOB model. If you think about GMX architecture, I don’t think a non-CLOB GMX sort of architecture will work with altcoins. That’s just my long-winded way of summarizing the answer to the question.

Danny: Absolutely, I think the point of BNB is very valid and interesting. I mean, there’s not too many other coins that have the same kind of volume and the same kind of ecosystem behind it that achieves the same scale. On Cliffton’s side, you guys are moving to Cosmos, so what is dYdX doing to ensure there’s a smooth transition?

Cliffton: The main area of focus for us is to actually ensure that the migration from Starkware on Ethereum to Cosmos is done well. There are many aspects on that front, like token migration and liquidity migration, while also ensuring that in the early stages, dYdX on Starkware actually runs in parallel with the new dYdX exchange on Cosmos. Ultimately, once the V4 mainnet is launched, we’re definitely open to exploring collaborations and integration with different Cosmos chains and even other chains in other ecosystems to bridge the liquidity, but honestly, our focus right now is just to hash out all the technicalities to ensure that the migration is done well.

As far as the user experience goes, I don’t think there’s going to be a big change. The only actionable that the everyday user of dYdX needs to do is to probably bridge their tokens over from Ethereum/ERC over to the Cosmos standard. Right now, nothing is cast in stone as far as the migration goes, and as far as liquidity migration goes, we’re working super closely with all of our LPs and market makers just to make sure that we communicate what the transition plan is. Again, as mentioned, we want to make sure that the user experience is not compromised during this migration, so liquidity on V3 will still stay for a while, and the Starkware product is actually going to be running in parallel with the Cosmos V4 product for a few months before everything is completely transitioned over.

As far as governance goes, we’re exploring how token voting is going to change. Ultimately, tokenomics is going to be in the hands of the community to decide on. So we’re definitely opening up discussions to the community to discuss and decide if they want to change tokenomics, token emissions, how validators are actually compensated, and what are the different governance structures that can actually be used instead of the “one token, one vote” model which a lot of DeFi protocols are using right now. Obviously, there are a lot of inefficiencies on that front, so we definitely encourage discussions around potentially coming up with smaller communities that maybe can execute changes without going through an on-chain vote. These are all open areas of discussion that we’re actively fostering among the community.

In V4, again, since it’s going to be completely decentralized, just as “Rome doesn’t get built in one day”, what we’re doing is that we’re progressively decentralizing. We’re powering our community to have these discussions and empowering them to take actionable next steps. Hopefully, once V4 mainnet launches, liquidity, the user experience, as well as governance can all be kind of settled in. we’re looking at that to probably go live in Q2 or Q3 of next year.

Danny: Awesome, that’s great. Maybe some final comments from both of you before we go to questions. For O, maybe just one quick point about the thing that most excites you about 2023 as a hedge fund, and for Cliffton, you can add to it as well. We’re not requesting anything that’s confidential or not public yet, but if there’s anything as a teaser/trailer that you can leak out to the community here, that would be great.

O: Alpha leak!

Cliffton: Should I go first? I can only speak for the dYdX Foundation, which is actually different from the dYdX Trading, and we’re all part of the dYdX DAO. A big focus on our end is to again help the dYdX DAO to progressively decentralize, and this doesn’t have to wait until V4 mainnet is launched on Cosmos. We’ve actually released the blog posts on our take of how the dYdX DAO could look like. TL;DR, it will likely consist of several autonomous sub-DAOs, where each will work on different core functional areas of the protocol and are ultimately be accountable to the dYdX community. For instance, we’ll have sub-DAOs that focus on risk, some sub-DAOs that focus on marketing and growth, and some sub-DAOs that focus on our Hedgies, which is the dYdX non-fungible token (NFT).

We really think that an interesting governance model for a DAO would be to explore how different sub-DAOs can each operate in their niche areas with their own subject matter expertise and potentially make decisions with their own discretion unless it’s something that involves a huge change; that will probably need to go on the governance vote for the entire community to vote on. More recently, our community has voted in favor to create an ops sub-DAO, which will focus on operations, the “non-sexy stuff” like setting up infrastructure for both off-chain and on-chain collaboration, creating a fiat bank account, payment system, establishing and maintaining a DAO communications platforms like forums, Slack, Telegram, etc., and sourcing and establishing relationships with different vendors and service providers. So as per any other company and any other organization out there, it’s super imperative for this initial operations team to be fully functional because without operations, most organizations fail. That’s something that, hopefully, this sub-DAO can take on and address before the wider DAO is actually built out.

One super exciting deliverable on our end that’s also being worked on is creating a DAO playbook. This will essentially help the community and the larger crypto community, not just dYdX, to know how to create their own DAO or their own sub-DAOs. This playbook will actually include topics such as what legal wrappers to use and what entity considerations you should think of—whether it’s a Cayman foundation or a Guernsey purpose trust or any other legal wrapper. Depending on the nature of the sub-DAO, what are some of the priorities from an operational end that you need to consider when you’re building a DAO? It will include things like our recommendations and general management suggestions as well. So, hopefully, this will serve as a public good that the crypto community can use to create more DAOs in the future. All of these are in the works right now, and we at the dYdX Foundation are continuing to engage and empower the community to lead these discussions and continue to build on. I alluded to this earlier since O did mention an alpha leak—when it comes to fee switches or getting trading fees to be distributed to token holders, I do want to mention that on V4, ultimately, it’s going to be completely community-controlled, and whether it’s dYdX Trading or dYdX Foundation, we’ll not have the ability to receive trading fees at all. So again, it’s really up to the community to decide and discuss, to work together on how fees can be distributed to continuously incentivize growth for the protocol in the long run.

Danny: Awesome. O, do you want to take the stage, or should we try calling @coinflipcanada instead?

@coinflipcanada: Let me give it a shot. Is this better now? I found an old phone. Carrying on what Cliffton was saying, I was just going to say that I actually do think that 2023 is the year that we’ll see how DAO and DAO governance models develop and the direction DeFi protocols decide to go. To use the example, what dYdX Foundation and DAO are doing is that they’re replicating a lot of different functions. You’re going to find other DAOs that go in the direction of narrowing down what they’re doing and seeing if they can partner with other DAOs or protocols that can take on other pieces of that experience. I think there’s going to be a lot of interesting models that develop, some that are going to parallel what’s happening within the traditional world’s structures, and hopefully, new structures will also start to develop. I’m actually quite excited. I know that’s not the core of what we at GMX do, but we do spend a lot of time, just as Cliffton was saying, looking at how governance evolves in a way that helps to improve and guide forward these protocols. It’s not just voting on one or two things, which currently seems to be the way that a lot of governance looks.

Danny: Awesome. O, do you want to add any other alpha leaks, or maybe we can open the questions to the floor?

O: No, no, go ahead.

Danny: So we’ve five minutes left with the scheduled time slot. If anyone on the floor has any questions, please feel free to raise hands.

I think we’re not seeing too many questions here. I hope everyone enjoyed it, and I would definitely show my gratitude to the three panelists here. Not financial advice, but I personally really use quite a bit of both of the protocols that are present today. A big thanks to @coinflipcanada and Cliffton for bringing great products to us as a community, and also, thanks a lot to O, who shared a lot of the views from a trader and investor perspective tonight. Also, a big thanks to everyone in the community who’s been supporting Treehouse and DeFi in general. I think we’re going to make it based on the attendance tonight. Hope everyone enjoyed it. Have a good night for those who are in Asia, and have a good day for everyone else!

Listen to the full panel discussion on Twitter Spaces here!

Check out our previous In the House conversations:

In the House #2: AlphaLab Capital – The Institutionalization of Blockchain

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

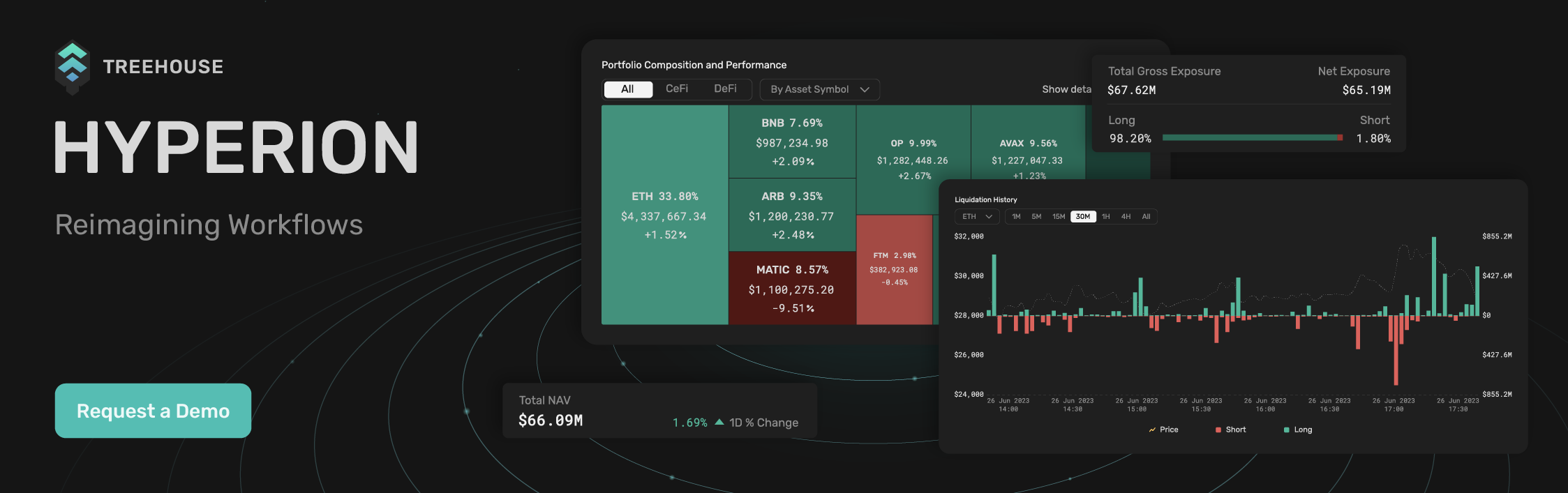

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.