Treehouse hosted a panel discussion on Twitter Spaces with panelists Brandon Goh, the CEO of Treehouse, John Gu, the CEO of AlphaLab Capital, and Kenneth Bok, Managing Director of BLOCKS and author of “Decentralizing Finance”. Stephany Zoo from AlphaLab Capital moderated the discussion on “The Institutionalization of Blockchain”. Find the complete discussion on Twitter here.

Read on to find out how the panel discussion went!

Part 1: Introduction

Stephany: Good evening everyone! My name is Stephany, and I’m the Head of Marketing at AlphaLab Capital. Welcome to everyone joining us tonight on this wonderful panel discussion with some very illustrious speakers. The topic tonight is “The Institutionalization of Blockchain”. Blockchain has occupied our mind space, heralding itself as the defining technology of our era. Despite the speed of development, mass adoption has yet to take off, especially among institutions. In this session, we will discuss several of the key pillars that may hinder adoption and how that can and should, evolve to enable this mass adoption.

I’d love to start off with a quick introduction from our panel of speakers, starting off with Brandon from Treehouse.

Brandon: Hey Stephany. Thanks for getting us on this call. I’m Brandon, the CEO of Treehouse. Essentially, Treehouse is a crypto DeFi analytics database provider.

Stephany: Let’s go to Kenneth first, who is the author of “Decentralizing Finance”.

Kenneth: Yes! Hi everyone, a very good evening or afternoon. My name is Kenneth, and I’m writing a book about DeFi. It’s called “Decentralizing Finance”. Previously, I was Head of Growth and Strategy for Zilliqa, which is an L1 (Layer-1) that was incubated out of the NUS (National University of Singapore) Computer Science department here in Singapore. Also, I’m an early investor in Ethereum, Cosmos, and Tezos. I’ve been looking at L1s for a long time. Also, I enjoy investing in various projects. Way before that, I was a trader with Goldman Sachs.

Stephany: Great, thanks so much, Kenneth. Let’s come back to John.

John: Hey everyone! Sorry for the technical difficulties here. I’m the Founder and CEO of AlphaLab Capital. My background was in algorithmic proprietary trading, so I worked in places like Citadel and Tower. I first heard of Bitcoin back in 2013 or 2014 when it was incredibly illiquid and inefficient, and it was very difficult to trade. I founded AlphaLab in 2017, and this was during Ethereum’s ICO (Initial Coin Offering) boom. It was a very different scene then, compared to today, in terms of the caliber of people entering the space, as well as the type of projects that are getting built. Today, we’re about 80 people, primarily market makers in the space. We do a bit of VC (Venture Capital) investing, as well as helping projects build liquidity in the ecosystem.

Stephany: Great, thank you so much. We’re going to start off a little bit more general and then get a little bit more specific and controversial as our panelists share more of their opinions.

Part 2: Panel Discussion

Stephany: Let’s kick it off. What was the defining moment for each of you that led to your embrace of the industry? You come from very different backgrounds, but more on the TradFi (traditional finance) side, so what changed for you? What led you to DeFi?

John: I actually have a story about my journey here. When I first started, it was simply trading, and we didn’t really care about the fundamentals of what we traded because it was very short-term and high-frequency. What I saw was a very inefficient marketplace, and it was quite straightforward to make money through trading—either arbitrage or market making. So, that was it, and this was, again, during the first ICO boom when anything and everything was getting funded, and some of it wasn’t necessarily of the highest quality. I think what really changed was in 2020’s DeFi Summer, where we saw these applications that actually started to have product-market fit. Not only that, you really began to see the power of composability on the blockchain, that the building blocks – such as the ability to swap or lend and borrow – were getting built, and how easy it was to tie them together. That was very, very powerful for me. I think that’s when my mindset shifted a bit, and I said, “Hey, there’s something really interesting going on here, and it’s not all about speculation and FOMO (fear of missing out).”

Stephany: Great. Thanks so much for sharing that, John. Kenneth? Brandon?

Kenneth: I was very lucky to be in the Ethereum crowd sale that was way back in 2014, and it was a very serendipitous set of circumstances. At that time, I was writing an essay on my own, doing a Philosophy degree, and looking into Bitcoin. At the very same time, Vitalik and his team were raising money for the crowd sale, so I held that position. In fact, I forgot about that position until 2017. Then, all the “real things” started, and one of the defining moments actually was the formation of the Enterprise Ethereum Alliance. Before that, Ethereum was this “okay, you read about it on Reddit, and it was on Bitcoin talk”. It was only when I saw these corporate logos from Fortune 500 companies of every single vertical, such as UBS and BP, getting their IT departments together and saying that “Ethereum is actually really meaningful”, that I decided to go “all in” into the tech. So, that worked out very well financially for me, which also gave me the freedom to get into this full-time. Subsequently, I reinvested in some things that worked out very well at Cosmos and Tezos. I also got burned by a lot of crappy projects. I organized a conference in Singapore called “Decentralized” which sought to showcase the tech at that time. At that time, I saw things like Filecoin in New York, while we only had things like Bitcoin ATMs in Singapore. So, I thought, “Let’s talk about this a little more.”

At Zilliqa, I was in the operational role of trying to sell an L1 to enterprises, or at least grow an L1. How do we bring the tech mainstream? That was when the lightbulb went off for me to work in IT or software, and where I really realized the immense challenges of running an organization and being an executive. In general, it’s a couple of things for me. Now, as I’m writing a book, I’m looking at crossovers between my former life as a TradFi guy and this new space, and I think the potential is tremendous here. Of course, there are a lot of challenges, such as regulatory standards that need to be ironed out, but insofar as the tech is concerned, it’s hard to put the genie back into the bottle. That is what keeps me going. No doubt, we’re in a bear market, but the tech is real, and people keep doing really meaningful things in the space. That’s just a little bit about how I got into this.

Stephany: Thanks so much, Kenneth. Brandon?

Brandon: I’ve always had my eye on the industry and had close friends that bought Bitcoin in 2012, but I really only got involved when Uniswap and SushiSwap were first introduced. I was particularly blown away by the application of smart contracts enabling decentralized market making, especially having previously worked at Morgan Stanley’s fixed income desks. It was really cool to see code acting as an intermediary, facilitating price discovery and the exchange of value while really lowering the barriers of entry for regular people on Reddit to get involved with what was usually only open to well-capitalized financial institutions. That really led me down into the rabbit hole.

Treehouse started because of trouble that I faced through my journey in DeFi – having to make do with portfolio management systems (PMS) that were subpar, and could only really show you just your balance today. So, I got some friends together, and we started building a PMS, just among ourselves, and we realized that whatever we did as a proof of concept could actually work. A lot of people in the market were interested in what we were doing, and that led me down this path, and I’ve not turned back since.

Stephany: Great! I think that there’s nobody better to be having this conversation with than three TradFi guys that turned into believers of the usefulness of DeFi for institutions. Let me throw this back to you, Brandon: Projecting the benefits that you personally experienced from using DeFi at an institutional level, do you think those factors still hold true?

Brandon: Yeah, definitely. Smart contracts and blockchain technology really exist to provide a new alternative to value creation and value exchange, largely in the form of removing intermediaries. As for the application of it, especially on the institutional side, I feel that it can remove many deadweight inefficiencies and, generally, level the playing field through clearly defined code. Much of the usage in the early years was largely confined to early adopters in the consumer segment, and only simple applications such as NFTs (non-fungible tokens) and payment systems for the institutional side. But I think we’re really starting to see institutions opening their doors to the space. Some topical examples I can think of that I would love to discuss—capital markets and fundraising, information sharing, reducing friction for private and public data, security, transparency, and even identity.

Stephany: Great. Some really good topics that we’re certainly going to dig into. So, going into that, John, maybe a question for you: What do you think are some of the fundamental ingredients that are needed for institutions to embrace blockchain technology? Maybe, going back to what Brandon was saying—reducing friction?

John: I guess I’m kind of a cynic at times. I think the fundamental ingredient is that they see opportunity, or enough of a threat, to overcome institutional inertia. Today, the way that the space has developed, there’s a tremendous amount of trading volume, and there’s a tremendous amount of interest from VCs in terms of what the technology can do. Basically, a lot of these bigger players are looking and saying, “Hey, even from a risk-mitigating perspective, we should be involved in some way; we should hedge our bets.” Certainly, for others, there’s money to be made by providing and facilitating a service. For example, things like custody or trading are pretty obvious ones. I think just the perception that something really fundamental is going on and shifting and that the existing players don’t want to miss out is a huge motivating factor. I think it’s not something to be underestimated—how much effort it actually takes to overcome some institutional inertia, and the fact that the space was able to do it slightly outside the system is pretty amazing.

Stephany: Great. Kenneth, do you have some thoughts about this?

Kenneth: I agree with what both Brandon and John have said. The tech is real, and the fact that, for instance, USDC transfers are a lot easier than a bank transfer says a lot. If you want to start with what I call the “verbs of finance”, you can pay, you can invest, and you can participate financially in all these different activities. At the core of it, if I can pay someone across the world with just an address such that I don’t need to go through a bank, and it happens nearly instantaneously, it brings about a similar comparison between Napster and Spotify. To be clear, we’re in a Napster-kind-of era in DeFi, where things are quasi-legal or quasi-illegal, but it’s only a matter of time before regulation catches up. As far as tech is concerned, society always moves forward with tech. We always find ways to let the tech shine, and we can’t go back on usability. That’s where it starts for me.

The more complex question of what it takes for institutions to utilize DeFi is a legal question, a regulatory question, and a standards question. I draw from my experience at Zilliqa—we were a general L1, and we met a lot of enterprises that were interested in the technology, but it wasn’t always an easy sell because it was all too general. They needed to contribute developers in order to develop these POCs (point-of-contacts), and then it would take time for them, and it would be too costly, and they couldn’t be sure that their problems would actually be solved. For most institutions, what they want are easy solutions that have benefits verified by other businesses. That’s where the gap is closing for DeFi, and a lot of that is regulatory in nature. For large institutions, their hands are tied. They have all these different requirements they need to adhere to— compliance, and all these crazy requirements that are thrust onto big businesses. Otherwise, they get sued. There are many things stopping DeFi from becoming mainstream. Maybe one other example here is video games: you would think that for an internet-native audience, NFTs would be a good fit, but there was so much pushback from their communities when these big game companies wanted to push out NFTs. Part of that is just suspicion, but also, an ESG (Environmental, Social, and Corporate Governance) issue with the space. There’s so much nonsense that goes on in the space that even your internet-native gamers are skeptical of some of these things, so I would say that it’s a very complex picture that is still evolving.

Brandon: That makes sense, and I would just like to add that I agree with you, Kenneth, that regulatory clarity and all these things are definitely important. It’s definitely also a “chicken and egg” issue because, fundamentally, infrastructure is pretty lacking, so infrastructure definitely has to improve for more institutions to come in. I’ll bring up two points: one, I believe there’s a lack of standardization and conventions. Relating to what we do at Treehouse as a data company, we have to scope down to the smart contract level, and the way different developers write for different protocols can be entirely different, even though they are doing the same thing. Something even bigger is the UI/UX problem – just setting up something as simple as a wallet, transacting through different blockchains, or the interoperability between them – I think there’s a lot of room for improvement that the ecosystem needs to go through before we see more institutions coming in. But of course, this also opens up the opportunity for institutional innovation to step in to help in this.

John: So, I have a question for you guys, Kenneth and Brandon. Coming from the U.S., where the banking system is open 9 to 5, and the wire transfers take a day to do, certainly, with examples like USDC transfers, it is much more convenient. But having experienced the banking system in Singapore, for example, with PayNow, or similar services in Korea, it’s actually way better. It’s also 24/7, very easy, and much more intuitive UI, so in a sense, I think there’s the technology part, but I’m curious, do you think it’s fundamentally a tech innovation or something else? With the money transfer example, it’s not the tech that is blocking the improvement. The tech is there. It’s just that people aren’t building it or using it.

Kenneth: Yeah, you know domestic FinTech is actually really good with any kind of developed country that has gotten their act together—real-time payments are kind of the norm. Now, what it does solve is this international internet-native space because there is no international finance regulator. There’s the IMF (International Monetary Fund) and BIS (Bank for International Settlements), but there is no international financing. That’s why cross-border payments have been such a pain for so many people, and that’s where DeFi really has a big potential to be able to solve this problem. The piece there unlocks a whole bunch of innovation is talent. I also reflect on my experience: I’m sure you guys have also encountered this in TradFi, where IT is the back office. What this means is that these bright developers cannot work on financial products, as it’s driven by the entire bureaucracy that puts so many layers between the customers and them. Whereas in DeFi, they can just do what works and they can monetize easily, and that is huge and not talked about enough. This allows more people to work in this space, and those who want to work in this space no longer have that friction. They are able to just innovate with their financial products. Generally speaking, I would say that FinTech has come a long way and that everything you want to do domestically is actually really easy. It’s when you come to the cross-border stuff that DeFi actually makes a lot of sense, given the way regulations are at the moment.

Stephany: Yeah, certainly. There are various applications around, and you know these conversations as well. There are a couple of enduring topics that have split the crypto community on how these protocols should be run, so I’m curious if there was more consensus on whether or not this would actually enable institutional adoption of blockchain. I think for some of the topics that we have discussed relating to institutions, on the one hand, John talked about hedging risk and making sure that they are taking opportunities out there. But on the other hand, as Kenneth said, they want to make sure they are getting involved in things that are already working for other people, and they don’t want to be the guinea pigs in this situation, which leads me to my next question: To what extent should blockchains be centralized or decentralized?

For instance, there are conversations around Solana and the number of validators. There are a lot of new L1s that are popping up and that are very hot, so what do you guys think—centralized or decentralized?

Brandon: Yeah, sure, I can take that. So to answer the question of whether blockchains be centralized or decentralized, I think there’s room for both, and it really depends on what you’re optimizing for. Different blockchains can be built for different use cases. Maybe I can speak more towards the decentralized side, given that we’re in the decentralized space. For Treehouse, I think this spirit of decentralization is about giving back to the people. But even so, I think it’s still a work in progress despite being here for the past two to three years. To me, the key to good decentralization is really good governance, to ensure the longevity of the blockchain. I’d like to give this quote from Winston Churchill, which says, “ Democracy is the worst form of government except for all the others that have been tried.” I think decentralized systems need to have some form of governance built in place to be able to determine internal processes, and to give voice to different counterparties and ecosystems in a way to institute a system, largely to avoid gridlock. I think we can look to history as a guide: separation of powers, checks and balances, and more. You see that in applications and in different ways through blockchains and even protocols.

Kenneth: I’m maybe a little bit less ideological. What I would say is just based on observations that I’ve had over the space for the last couple of years, there’s Ethereum which actually runs very reliably, and then there’s Solana, although, since ETH 2.0, gas fees have been quite low. But Solana has a lot going for it, it has high throughput and low cost, and the chain goes down, but it comes up again. Generally speaking, my experience with Solana has been pretty good. With that centralization, which is very broad, you get a whole innovation system that’s based on this nexus of Jump, Multicoin, Solana, and FTX, and that has enabled quite a lot of innovation. There are certainly advantages to centralization as well. The products within the Solana ecosystem are pretty decent. Mango got hacked, but you could do some pretty cool stuff on Mango. It was like a decentralized futures marketplace, and they were doing options. Do you know how advanced some of these things are? They’re actually quite meaningful. Then, there is Hyperledger and Coda, which are kind of extreme. Some people don’t even talk about them as blockchains, but they exist, and they are almost at the far end of centralization. They solved problems for enterprises, and, like it or not, they are also part of this blockchain conversation. So, in general, I still think that among the three kinds of buckets I mentioned, they all solve different issues here, so I have to say that there are different courses for different blockchains. I think it’s still up in the air as to which three are going to win in the long term.

John: Yeah, nothing really to add to what Kenneth and Brandon have said. I think they were spot-on. As a pragmatic matter, you want people to experiment and to innovate in various parts of the space right? There are different trade-offs made to solve different problems, and that’s just the nature of engineering.

Stephany: So, coming back to the context of institutions, oftentimes, institutions are likely to get more involved when they feel safer, and that often comes with regulatory oversight. Do you see there being space for regulatory oversight in the blockchain ecosystem? If so, when and how should regulators arbitrate to be a beneficial force for the ecosystem as a whole?

John: Yeah, that’s a really complex question. For the first question that you have: which regulator? Because each jurisdiction may have different rules for different ways in which they view rights, so one consideration is clarity from the regulators as to what they want to do. I think in the U.S., there’s some connection between the CFTC (Commodities Futures Trading Council) and the SEC (Securities Exchange Commission) about who gets to regulate tokens and whether they are securities or commodities. Then, you have to think about how it’s regulated across different jurisdictions. In the blockchain, oftentimes, it is borderless. In a sense, people can access the blockchain from any country. So, how much do you want to bend the regulations of a particular country? But I think right now, because of how much adoption there is, we need clarity about what the rules are. I think, oftentimes, the rapid innovation that we see is really good, and it is also a form of regulatory arbitrage, because if you were to do the same thing in a centralized context, for one, there would be so much red tape that you wouldn’t do it, and it would be a highly regulated activity. So, there’s this sort of getting clarity and balancing out the ability to innovate quickly with appropriate protection for the different stakeholders.

Kenneth: Yeah, I agree with what John said that it’s not an easy question to answer. It’s not as clear in Singapore as in the States. I might be able to add a dimension here about regulation because it tends to be seen as a negative thing in the DeFi space. You have to differentiate between the intent of regulation and the implementation of regulation. The intent of regulation is generally for the benefit of the consumer and is meant to protect the consumer. It’s meant to protect people from abusers within the space, and it’s meant to allow for orderly markets. The fact that most people can just use FinTech applications without worries about their money disappearing is due, in large part, to the invisible work of regulators. They are the ones that are behind the scenes, making sure that things work as they should. So, I will say that it’s kind of hard to argue against the intent of regulation.

The implementation of regulation is where it gets tricky because regulators have never tried to regulate the decentralized financial system before, and it’s not an easy job. That’s why my own inclination is that they have to come up with new ways of regulation, which sounds very ominous! But there’s actually a contract out on the EU side of things to do embedded RegTech (regulation technology). These are regulators operating nodes, so they have an overview of the DeFi ecosystem—that is tech-enabled. In this regard, obviously, firms like Elliptic and Chainalysis have done a lot in terms of helping new law enforcement regulators with observing the blockchain. That space is really necessary to enable DeFi to go mainstream, in my opinion. It actually necessitates recognition because if not regulated, then it will always be confined to the internet. With real-world businesses, it’s hard for them to adopt things that are just internet-native because there’s no regulatory certainty. So, in general, I would say that the intent of regulation is good, but the implementation of regulation is, sometimes, outright poor. In regulatory regimes where some of the regulators are just not clued-up or not incentivized to make sure that they are doing their jobs right, that’s where we have all the ills of government and so forth. It’s a very complex question, and I don’t envy the regulators either.

Brandon: Yeah, I would agree to that. I think there’s definitely room for high-quality, evidence-based regulatory decision-making, but it’s a tough job because the space is so new, and it’s a very thin line. I agree with you. You have to understand the intent and when the purpose of regulation is really to protect retail, while keeping the fabric of society. On the other side, you have protocols where jurisdiction matters, something John brought up. Some jurisdictions allow you to travel at 200mph while some limit you to 60mph, so it’s kind of hard, and it’s a very thin line. But I think the key goal for regulators is to root out fraud and take out scams, then ultimately, connect retail investors to the best investments that suit their profile. Retail education is obviously an important part, and regulatory education provides better data for them to understand this space.

Stephany: Everyone on this panel is so balanced, and everyone just agrees with each other even though I’m trying to ask contentious questions that may lead to differing opinions, so let me try another one. To what extent should the notion that “code is law” be pushed, especially when the content of the situation may not match up with the initial intention of the creator?

Brandon: That’s a pretty interesting one. I think it’s important to look at history to see how we got here and to best appreciate the phrase, “code is law”. Philosophers have always tried to rationalize how societies have advanced, and the Greeks first used what they called the “Rule of Law”, explaining it as the connection formed by society, individuals, and the state over time. Then you have Thomas Hobbes and his theory of human motivation, introducing the concept of Social Contract Theory. I think “code is law”, to me, is a somewhat new way of thinking. Call it a smart contract theory, perhaps, a new wave of what society could be undergoing right now, whereby the introduction of smart contracts and code for the first time in history ever is starting to dictate certain aspects of human living. So, in its purest form, smart contracts enable contractual obligations to be uniform, safe, and cheap while also decentralizing intermediaries. To answer the question of which instance should the mantra of “code is law” be pushed, I feel it’s very situational and, ultimately, I think it’s driven by consequences. Drawing a line here is going to be quite tough, but in general, you should definitely push it at points in the industry because the industry can learn from its mistakes, such as the very recent Mango Markets hack. But maybe not in cases where these bad actors might be outrightly misusing public trust, such as in rug pulls and ICO scams.

Kenneth: I find myself a little less ideological than when I started out in the space. Obviously, the DAO (Decentralized Autonomous Organization) hack, in some sense, was a big watershed moment for testing this theory. I think they did the right thing. On the whole, the community came first. In most situations, the “code is law” hardliners would be overrun by the community—that’s just a pragmatic point. The other dimension to this “code is law”, is smart contracts. It’s so unhip to say that smart contracts are not smart and are not contracts at all. There are some hilarious law professors who always go on LinkedIn and say, “It’s’ not a contract!”. Well yeah, it’s not a contract. It’s marketing. Code was never meant to involve lawyers. Of course, to really match up to the promise of smart contracts – automating everything, digitizing your whole life, making sure you have a skin in the game, and you can perform all these economic actions with smart contracts – that vision is still a vision. We don’t have an identity that is really linked to the blockchain. There are so many things that need to be ironed out before you can really fulfill the full promise of smart contracts. Putting on my futurist hat, in general, “code is law” actually makes a lot of sense! So much can be done with software in terms of enabling more efficient societies. It’s just that “law” is very subjective – it’s insanely subjective – and that’s where you still need human beings to adjudicate. To look at insurance claims, you need lawyers to litigate on your behalf to understand the ins and outs of the situation. There are some situations where it can be automated. In the context of the blockchain, I think it’s not true that “code is law” hardliners have actually won. They always seem to have ceded to the community.

John: Yeah, unfortunately, there is violent disagreement that code is definitely law. There are happy cases, and we want to maximize the use of the happy cases where the code runs as expected, the inputs are within normal expectations, and everything is efficient and good. Fundamentally, the way I would think about it is what provides the maximum value or utility for society. It really is a matter of intent, right? No one feels like a hack that’s outside the expectations of the writer of the code is actually beneficial for the ecosystem. Insofar as a robustness test and the bounty of making better designs, then yes, there are some arguments to be made there. But by and large, if you’re spamming the blockchain or if you’re doing these sorts of attacks, it’s not really benefiting anyone, or it’s benefiting one individual or group at the cost of everyone else, which is not what the intent should be. In my mind, “code is law” just doesn’t work, especially when you’re talking about code that’s trying to intermediate against a complex set of actors that are very incentivized to break it. So, you do need the nuance and interpretation of what the intent is.

Stephany: Does Brandon or Kenneth want to add anything, or disagree or agree with anything John said?

Kenneth: To be frank with you, I haven’t read the philosophical guiding principles to the formation of the blockchain. That, for me, is where it starts, and that’s where the differentiations between ideologies surface. When you form a country, you have a constitution, and it guides the principles of a collective group of people. But I haven’t quite seen the same equivalent for blockchains, because there’s this implicit assumption that it’s gonna just work, and that the developers would come in and fix it if it doesn’t work. So, something is missing there for me. What do you guys think?

John: It’s interesting because you mentioned democracy, and I think you know companies generally aren’t run as democracies. You also kind of abandon that in times of military conflict, right? Martial law is explicitly not democracy. So do you want to move quickly, or do you want to be resilient? Generally, in a democracy, one bad actor can’t really ruin the system, so it’s resilient against a lot of things versus something where one person or a small group is in control. If they end up being incompetent, then it’s just over, right? If you look at most projects and most things in the blockchain, especially in the beginning stages, you just can’t have democracy; nothing would ever get done. It’s very hard to coordinate human activity across a large number of people in that way when you need to move quickly. It’s interesting how the DAO movement is experimenting in terms of how to coordinate or incentivize coordination of human behavior in a very diffuse and distributive fashion. I personally am a little bit skeptical there about the philosophy of it. I think, at the end of the day, a lot of things on the blockchain are done with trust, on a handshake. Everything that the blockchain professes with regard to trustlessness is not necessarily the reality that exists right now.

Stephany: I think that was certainly proven in a lot of ways when it came to TOKEN2049 and how important and how excited everybody was to be in the same space and to make deals and do partnerships and announce things together. There are still people behind the code and behind these projects that are looking to connect and work together, and there is that kind of collective ethos obviously in this space. Let’s go back to the “institution” questions again: So, how should institutions get started? Treehouse is a really great tool and resource to get them up to speed. I would love to hear from you, Brandon, the types of institutions that you work with and how you present the product to them, as well as any other great tools or resources for our guests who have sat out here to get them up to speed.

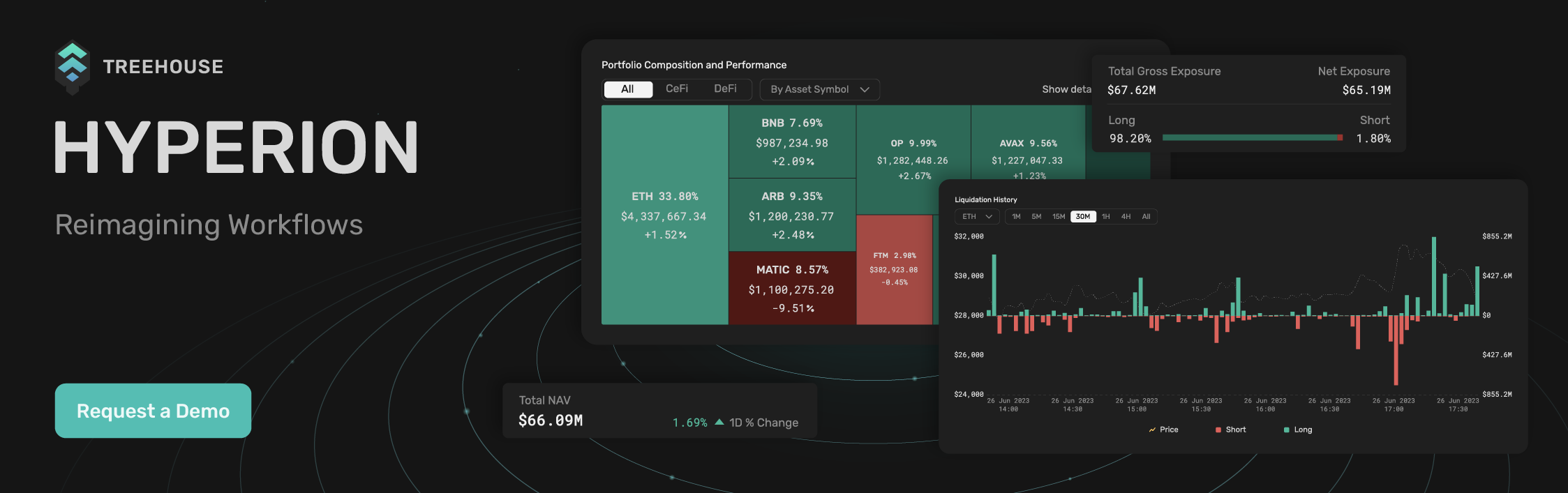

Brandon: Yeah, I could definitely speak from Treehouse’s perspective. We provide institutional-grade DeFi analytics from a wallet level. DeFi has been around for two to three years, and up till today, some of the largest funds are still trading on balance sheet snapshots without proper risk systems, so we really exist because we want to change that. Fundamentally, what we’re trying to do is to emulate what you see in the TradFi trading world and bring in a NAV (Net Asset Value) screen, similar to Interactive Brokers or Robinhood, and bring that into the DeFi world. For us, we think that for the space to grow, you need to have better tools and resources, and what we’re building exactly is focused on two elements. One, is on historical data, and two, is performance attribution to help drive trading decisions. There is still a lot of infrastructure, which comes back to the point that there is a need to build tools for institutions to really get their hands dirty. There are a ton of other tools and resources, and I would love to hear from John and Kenneth.

John: Yeah, on the trading side, there’s a lot of underwriting and risk-shifting. You have execution platforms like Telos, which connects different institutional actors in the space, and you have Fireblocks that helps with the problem of secret management and key management when you’re dealing with a large organization. Separating this idea of ownership of the assets and managing or doing things with those assets with some limited permissions, there are a lot of things that need to happen. We at AlphaLab, build a lot of what we need because when we look out in the space, for our case, trading, it tends to push the boundaries of these technologies, so we end up building a lot of it because we don’t see what’s in the space. I don’t profess to be very up-to-date on the others. I think Chainalysis and other KYC (Know Your Customer) and AML (Anti-Money Laundering) tools, essentially data and forensics analyst tools, are also there to satisfy regulatory obligations. But I think outside of trading, I’m probably less aware than Kenneth would be. I’ll pass over the buck to you, Kenneth.

Kenneth: Thanks, yeah. Maybe from a human capital perspective, it is a question of “do you engage an outside consultant or hire someone in-house?” Actually, my inclination is for the latter. On a high level, you should definitely get your toes wet, regardless of whether or not the business case actually warrants a gigantic investment or creation of a new arm or product line. You need to know what’s out there in the DeFi space and the crypto space, given that there are so many big partnerships like Google accepting payments, as well as Visa and Anchorage, and Twitter paying out in USDC. There’s a tremendous amount going on in various spaces. The other space is capital raising. There are debt capital markets that Daimler has tried, and SocGen has done some trials with MakerDAO in extracting DAI from that pool. There are actually tremendous amounts going on. The long story short is that I think you should hire a DeFi specialist in-house. Two of the largest credit-rating agencies, S&P and Moody’s and Poor’s, actually have an entire DeFi department already, so I find those very promising. Finding people who come from a crypto-native space or who can trade in-house and are savvy in DeFi, is a great way to start. Another thing is to buy my book for your whole company when it does finally come out next year. Training, obviously, is a big part of it. Getting good people to be able to educate your teams on what DeFi is and knowing the potentials and limitations of the technology is a big part of it. Apart from that, there’s also custody, which is a big gateway for a lot of people on the asset side. Then, there’s also prime brokerage and many other areas you can get into. Actually, custody is a big access point for a lot of institutions, but that’s just on the asset side. There are so many ways in which a large company has financial needs, when it comes to capital raising or payments, and it’s not necessarily just holding Bitcoin like Microstrategy. It really has to be focused on the business direction and intent, and so, I think hiring someone in-house is actually a really good start.

Stephany: Thank you so much for that! I think that it is an often forgotten aspect of building capability. Everyone discusses the technological aspects and the different tools, the subscriptions, or the integrations they should have, but for institutions who have such large databases of human capital to begin with, hiring in-house and being more open to the types of people who do have the expertise to help them keep up-to-date with the trends in the industry, in general, is also an option. Hopefully, we’ll have some bigger institutions participate in our next panel and maybe, share some case studies about how they are institutionalizing blockchain technology.

With that, I want to thank everyone who’s listening, as well as our speakers who touched on a wide range of topics, from regulatory oversight to fundamental ingredients for institutions. We also discussed quite philosophically across the board whether or not code is law. As long as we’re having these conversations and building products like Treehouse, or being alpha users for different institutional-grade products the way that AlphaLab is, or generally educating the public and other institutions like Kenneth is with his book, we can move the needle in bringing institutions into DeFi. So with that, thank you, everyone, for joining, and have a great night!

Listen to the full panel discussion on Twitter Spaces here!

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.