Today, we would like to introduce and welcome our first guest contributor.

Qijian Chen is the Co-Founder and Chief Investment Officer of Moonvault Capital, a hedge fund focused on arbitrage across the decentralized finance (DeFi) stack. Before Moonvault, Qijian spent several years as an options trader at Morgan Stanley in Hong Kong. We are excited to hear him share more about how he first got into the space, his investment approach, and what he thinks about the future of DeFi.

Brandon: Thanks for coming on, Qijian! Before we jump in, could you share with our readers how you first got into DeFi?

Qijian: Sure, thanks for having me on. I am excited to see more people in the TradFi world getting into this space. My journey in crypto started back in 2016, even prior to the advent of DeFi. Then, I was a Bitcoin maximalist – venturing only on Deribit to trade Bitcoin options. When I started, I knew I was extremely early as the Bitcoin volatility curves on Deribit were actually linear.

Brandon: True, the volatility curves back in the days were more in a shape of a frown. But just before we move further, could you share with the readers what it means when volatility curves trade linear?

Qijian: When you trade options, the usual volatility curve should generally skew something to the shape of a smile. For a market like crypto with extreme moves, a flat vol. curve simply does not make sense.

Brandon: So you started in crypto as a Bitcoin maximalist, when was your “aha moment” for DeFi?

Qijian: Fast forward to 2020, I started hearing about DeFi quite a fair bit on Reddit and the online forums I frequented. Now I encountered quite a bit of vaporware from 2016, so I was initially quite skeptical. But after a few weeks of probing and investigation, I felt the same exact feeling as when I first encountered Bitcoin. This is starting to sound like a love story, but I knew that DeFi could potentially take off in a big way.

Brandon: Haha, fast forward that even more, and you are now the CIO of Moonvault Capital. Could you share a bit about how the fund started as well as the thesis behind your investments?

Qijian: Moonvault Capital is a DeFi focused fund. To put it very simply, DeFi is still irrelevant to 99% of the world’s population. It has promise, much like how it was in the early days of the internet. But for it to fully realize its potential, DeFi needs to become relevant to the mainstream public in terms of its use cases. That is the core vision we have for DeFi and we have invested in what we think could become the eventual winners that would thrive in such a world.

Brandon: Indeed, DeFi has so much potential, but it needs to reach the mainstream. Investing in DeFi today feels akin to investing in any of the Big Tech companies back in the 90s. I am curious though… you have watched DeFi grow and morph through the early days, even before “DeFi summer”, how much more mature is the space now, and is alpha much harder to find?

Qijian: The space is definitely more mature from a time horizon perspective. However, I think when people talk about the “space”, they are talking about specific segments that are currently “hot” now. From that perspective, I do not think alpha is any harder to find. The hot balls of capital rotates so fast in crypto that most people are usually sidelined. If you put in the work and dare to have a variant perception, I still think you can get rewarded quite largely. From a much more fundamental perspective, the space is still fairly nascent with increasing variables – the most conscious one right now being regulations. The fact that you still have so many unpriced exogenous variables… Alpha is not necessarily hard to find, but alpha is hard to trade on.

Brandon: Regulation is definitely more of a question of “when” now then “if”. In crypto, we see many people who have made the transition from TradFi to DeFi very well. As someone who has made that transition, what are the key differences you see working as a trader in DeFi vs. TradFi?

Qijian: Working as a trader in TradFi means sniffing out and carving out many small edges throughout time. Working as an “investor” in DeFi – you actually need to wear multiple hats – researching for the next big segment, building out real-world partnerships… the list goes on and on. However, you get rewarded with more than a few bps usually.

Brandon: That is not exactly a joke. I think many of the people in DeFi are now extremely spoiled given the yields we saw on a daily basis during the summer. Speaking about the next big segments, what are some of the more exciting sectors you see within DeFi today?

Qijian: Within crypto, I see leverage trading platforms getting big. For the real world, payments and lending will likely be the main focus.

Brandon: I see that as well. Payments and lending will likely be the bridge that brings mainstream users aboard, especially once they see the efficiencies in using smart contracts, not seen since the creation of the internet. I keep coming back to the internet – DeFi is obviously challenging the giant institutions of today, but where do you see the space in the next 5-10 years?

Qijian: Much bigger and tightly integrated with the existing ecosystem. For sure – regulation is the elephant in the room, but I see it as a roadblock that will be resolved eventually.

Brandon: Got you! Thanks for taking the time of your day to meet and share with us some of your trade secrets. Qijian is a seasoned trader in the DeFi space and speaking to him everytime makes me feel like a sponge. Check out moonvault.capital for more information on their plans.

Qijian: Thanks for having me. We are excited to see how Treehouse grows and for you guys to be a staple in the DeFi ecosystem!

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

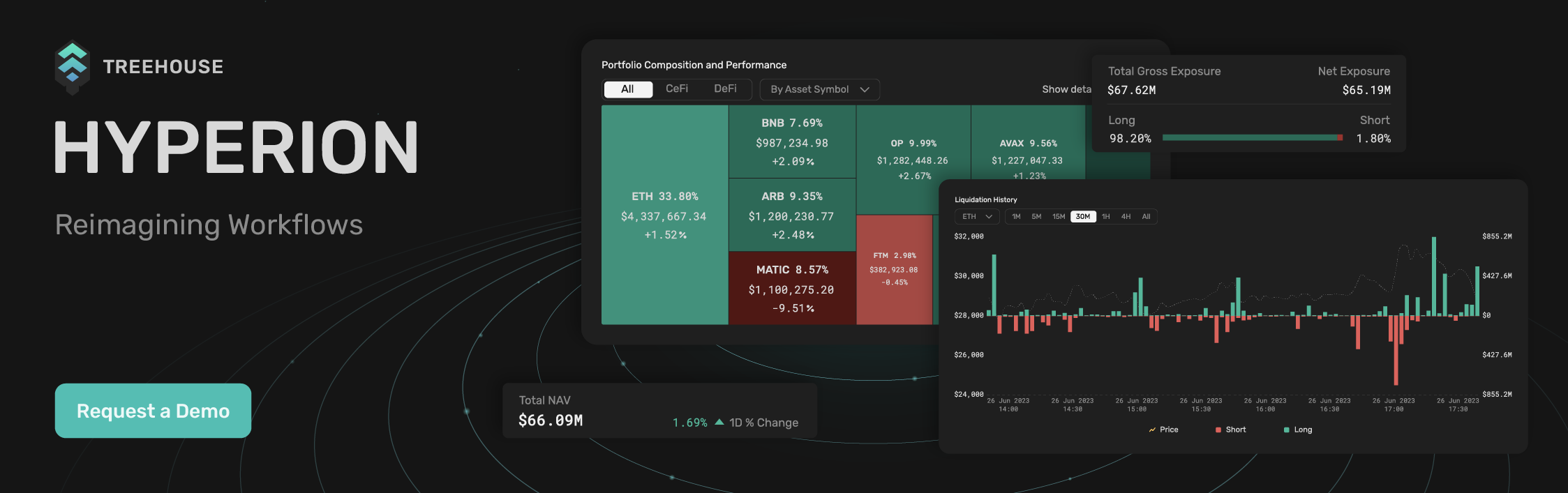

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.